SPECIALIZED REPORT “STOCK MARKET – APPLYING BUSINESS CYCLE ANALYSIS TO INVESTMENT”

Investing requires knowledge, proficiency with investment tools, and an understanding of market factors. The business cycle directly affects investment performance; capturing it correctly helps investors make smarter decisions.

To help students of the Faculty of Finance & Banking—especially third‑year students (cohort 22D)—understand the relationship between the business cycle and the stock market and apply it to investing; and to equip them with methods for cycle analysis, risk management, and trend forecasting, the Faculty organized the specialized session “Stock Market – Applying Business Cycle Analysis to Investment” on the morning of 19/10/2024 via Microsoft Teams.

Photo 1: Speaker Mr. Nguyen Ngoc Phuong – Sales Director, Yuanta Vietnam Securities.

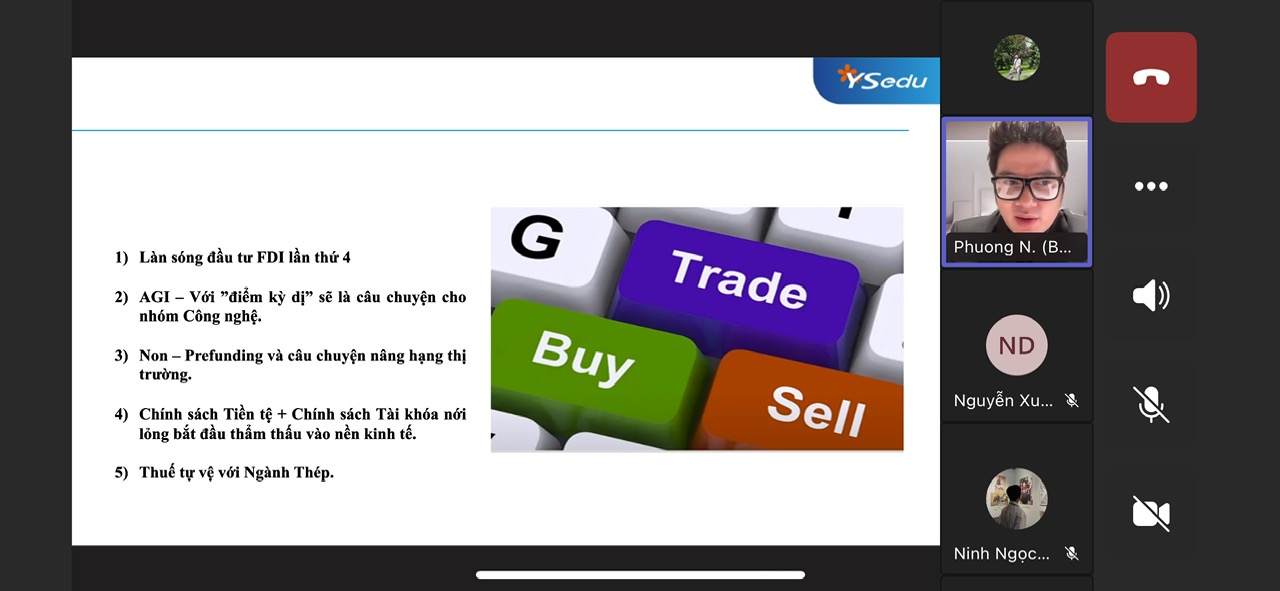

In the session, the speaker—Mr. Nguyen Ngoc Phuong, Sales Director, Yuanta Vietnam Securities—shared the following:

- An introduction to the business cycle and its stages: expansion, peak, recession, and recovery. Key economic indicators used to identify each stage include GDP, interest rates, and inflation.

- A discussion of the correlation between the business cycle and the stock‑market cycle, explaining the phase lag between the two and how investors can leverage the timing gap to optimize decisions.

- The TOP‑DOWN investment approach, focusing on analysis from the macro level to sectors and finally selecting suitable stocks; with experience on using macroeconomic information and industry trends to make investment decisions.

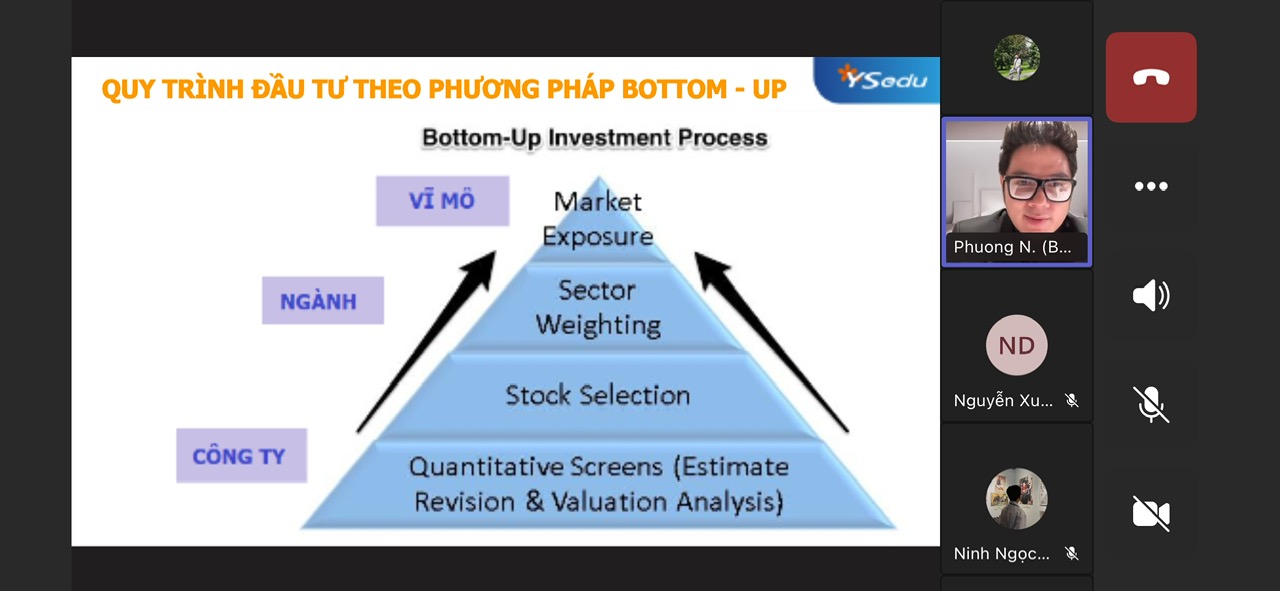

- The BOTTOM‑UP approach, guiding how to select potential stocks based on fundamental analysis of each enterprise with less reliance on the business cycle.

- Effective investment experience and strategies in the current economic context, lessons learned from the stock market, an introduction to investment support tools, and how to build long‑term strategies suited to each business‑cycle stage.

Photo 2: The speaker presents about the business cycle.

Photo 3: The speaker presents key economic indicators.

Photo 4: The speaker presents investment methods.

At the specialized session, students of the Faculty of Finance & Banking interacted and learned a lot through Q&A with the expert, giving them opportunities to apply theory to real‑world situations in the future.

Photo 5: Lecturers and students of the Faculty of Finance & Banking interact with the expert.

MSc. To Thi Hong Gam, Faculty of Finance & Banking